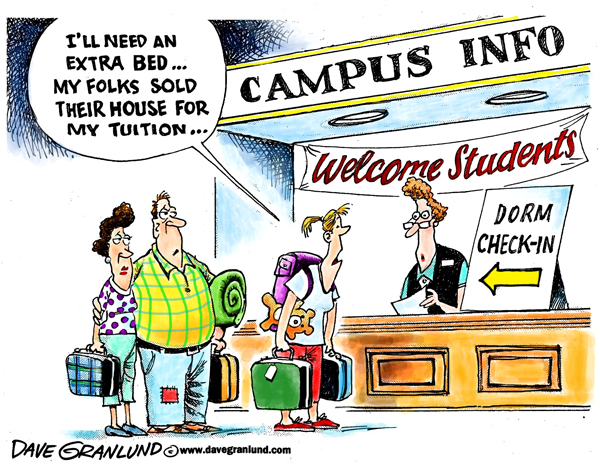

As a parent, you want to give your child the best possible head start in life. That may include footing the bill for his college education.

You and other parents who share this idea may be well-meaning, but you might be doing a great disservice to yourself. Here’s why.

It may sound like an unusual personal finance advice – prioritizing other expenses, especially your retirement over your kid’s college tuition – but that is anchored on sound logic.

Most probably, a substantial chunk of your take-home pay goes to your monthly living expenses. What’s left is divided among your outstanding debts, the help you send to your own folks, your retirement fund, and your kid’s college tuition. However, most people’s income have been in a plateau in recent years. Here, you have mounting expenses against income that has fallen flat.

But why should you prioritize other expenses, especially your retirement fund over your child’s college? The answer is simple, really: Time’s running out on you. Your kid will have a lifetime ahead of him to whittle down the debt he will amass while in college. You, on the other hand, may have limited options when it comes to funding your retirement nest egg. Plus, available data indicates that only a handful of parents are successful when it comes to footing four years’ worth of private education.

Of course, for most parents, the mere idea of prioritizing one’s retirement fund over his child’s college may seem despicable. However, there are a few strategies that parents and kids can utilize.

Talk to your kid

As early as possible, talk to your child and tell him that you cannot cover all of his college expenses. Instead, you can help him with some of these expenses. The rest can be covered with the appropriate solutions like scholarships, loans and part-time work.

Recalibrate your finances

Instead of putting your kid’s college tuition on top of your priority list, you have to turn your list upside down. On top of your list should be your retirement savings. Ideally, you should save at least 15 percent of your income. This should be followed by the debts that you have to pay. Next, prioritize putting together an emergency fund worth comprised of three to six months’ worth of living expenses. The last item on your financial list should be your child’s college tuition.

It certainly helps if you start as early as possible. For example, if you start saving for your child’s college around his birth, then you’ve got an 18-year head start. By the time he reaches college age, you’ll have a nice, big fund to fall back on.

Keep your options open

Discuss available funding options with your child. These may include scholarships, grants, part-time work, work-study programs, and even monetary gifts from relatives.